2folks.ru

Prices

Send Cash App To Bank Account

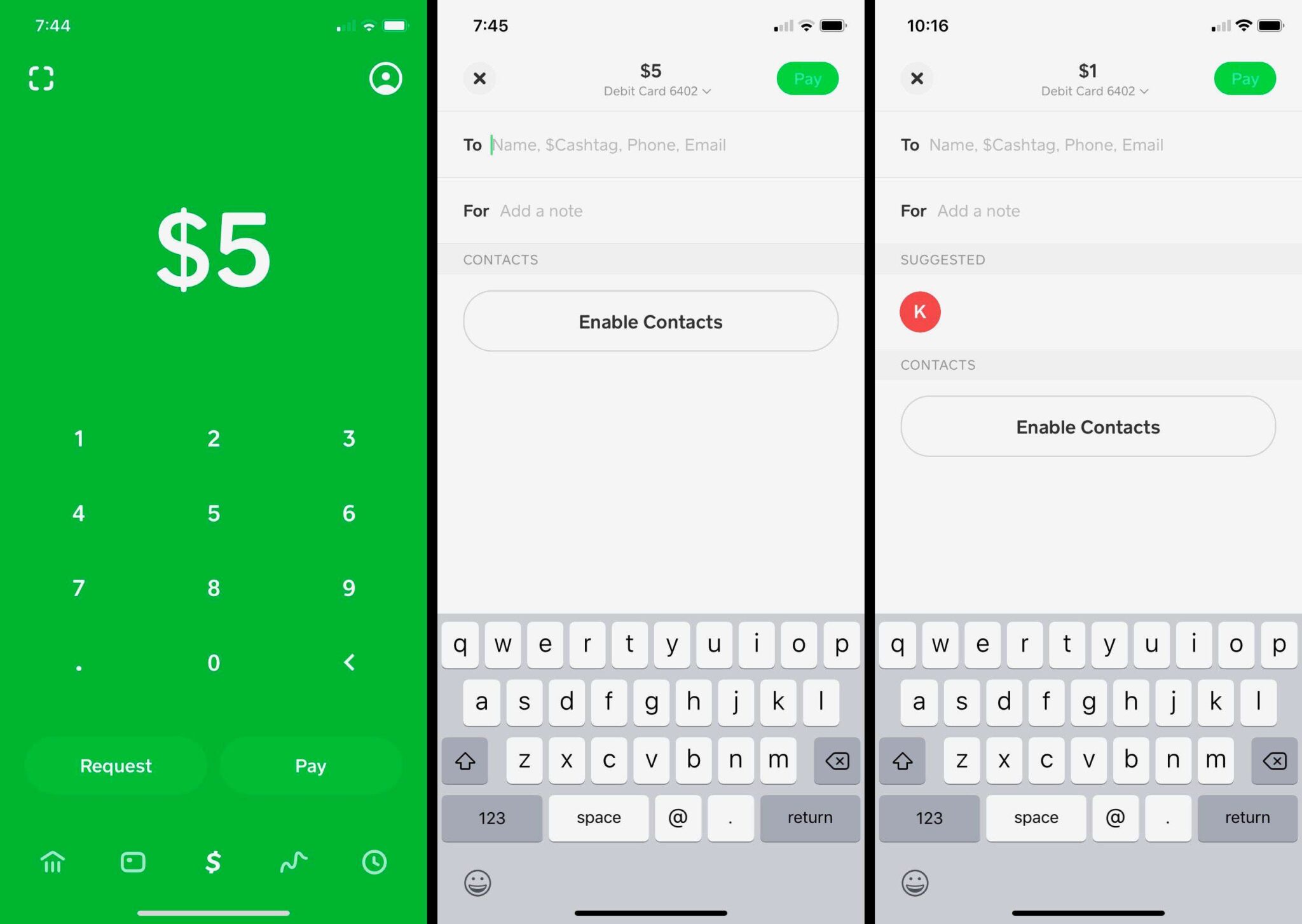

Ask your friend for the SWIFT code transfer details for their real bank account. Real name, address etc. If you only "know them" on the internet. If your recipient is already enrolled with Zelle®, the money will go directly into their bank account. Get Started. Why Use. Withdrawals to your bank account from your Cash App appear on your statement with the prefix Cash App. Tap “Add,” then use Touch ID or enter your PIN to confirm. How to transfer money from Cash App to bank account? Tap the “Banking” tab on the Cash App home. Join the millions of people who have trusted Remitly since to send money to friends and family overseas. More money makes it home to loved ones with. Next, tap on "Add Cash" and enter the amount you wish to transfer from your bank account. 4. Tap on "Add" and then choose the option "Use Bank. It's free to send and receive money, stocks, or bitcoin** within Cash App. Cash App is a financial services platform, not a bank. Banking services are provided. Look up and tap at the top, the app lets you select the source of the funds you're sending. Sending and receiving money is totally free and fast, and most payments are deposited directly to your bank account in minutes. Ask your friend for the SWIFT code transfer details for their real bank account. Real name, address etc. If you only "know them" on the internet. If your recipient is already enrolled with Zelle®, the money will go directly into their bank account. Get Started. Why Use. Withdrawals to your bank account from your Cash App appear on your statement with the prefix Cash App. Tap “Add,” then use Touch ID or enter your PIN to confirm. How to transfer money from Cash App to bank account? Tap the “Banking” tab on the Cash App home. Join the millions of people who have trusted Remitly since to send money to friends and family overseas. More money makes it home to loved ones with. Next, tap on "Add Cash" and enter the amount you wish to transfer from your bank account. 4. Tap on "Add" and then choose the option "Use Bank. It's free to send and receive money, stocks, or bitcoin** within Cash App. Cash App is a financial services platform, not a bank. Banking services are provided. Look up and tap at the top, the app lets you select the source of the funds you're sending. Sending and receiving money is totally free and fast, and most payments are deposited directly to your bank account in minutes.

In some cases, payments will be available in the recipient's balance instantly⁵. What are the limits on Cash App? Like many money transfer services, Cash App. 1. Paypal: Best overall · 2. Venmo: Best for sending money · 3. Cash App: Best if you like options · 4. Google Pay: Best for Google suite users · 5. Apple Pay: Best. No fee to transfer money from your Cash App account to a linked account with the standard option. The money is typically available in business days. $0. account or by using a bank transfer. To add money, open the Samsung Wallet app on your phone, tap the Quick access tab at the bottom of the screen, and then. Thanks! · Tap the Banking tab, which is located on the Home Screen. · Select the “Add Cash” option. · Enter the exact amount you want to transfer and tap “Add.”. Keep in mind that you can only have one bank account and one debit card connected to your Cash App account. Link Cash App with your debit card. If you'd like to. One way to transfer money from one Cash App to another without fees is to use the Cash App's "Cash Out" feature. Yes that means even if you choose Instant, the transfer can take up to 5 business days, that is normal, no way any human can speed it up. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Go to Transfer, External Transfer set up. Enter Cash Apps routing and account number. The bank will send over two tiny deposits and you write. In some cases, payments will be available in the recipient's balance instantly⁵. What are the limits on Cash App? Like many money transfer services, Cash App. Cash App is an online money transfer app. A Cash App user can deposit money into their account using another bank account. You can access your account on. Cash App is the easy way to send, spend, save, and invest* your money banks, plus you can pay bills with your account info. If you deposit $ or. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Send and spend, bank*, and buy stocks or bitcoin**. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank. Send money · Tap "Pay & Transfer" then "Zelle®," and "Send." · Select your recipient · Enter the amount and select your funding account. · Include an optional note. Zelle is a new way to send money to almost any U.S. bank account - within minutes via online banking or the Citizens mobile app. Learn how to send money. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is.

Is Investing In Gold Coins A Good Idea

Due to their small size, investors may find storage solutions more manageable. If you decide that growing your gold coin collection is right, browse through our. Either way, both collectors and investors have one thing in common: a strong appreciation for gold coins. If anyone could pick a day for the explosive beginning. What's wrong with buying gold coins? Gold coins and small bars are neither the cheapest nor the safest way to buy gold. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. No wonder: It's much easier to get gold. Gold investing can make a good idea for spreading risk across a balanced portfolio. That's because the value of gold bullion has tended to increase when other. Bullion coins are easy to transport and equally easy to store, making them a smart investment choice for savvy investors. Gold coins have been a popular form of investment, as gold offers great value and stability across the world. Buying a gold coin can be a smart move for a few reasons. Firstly, gold has always been a good way to keep your money safe when prices go up. Having gold coins. Investing in gold may provide investors with a hedge against inflation and economic uncertainty. It can also diversify an investment portfolio, reducing. Due to their small size, investors may find storage solutions more manageable. If you decide that growing your gold coin collection is right, browse through our. Either way, both collectors and investors have one thing in common: a strong appreciation for gold coins. If anyone could pick a day for the explosive beginning. What's wrong with buying gold coins? Gold coins and small bars are neither the cheapest nor the safest way to buy gold. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. No wonder: It's much easier to get gold. Gold investing can make a good idea for spreading risk across a balanced portfolio. That's because the value of gold bullion has tended to increase when other. Bullion coins are easy to transport and equally easy to store, making them a smart investment choice for savvy investors. Gold coins have been a popular form of investment, as gold offers great value and stability across the world. Buying a gold coin can be a smart move for a few reasons. Firstly, gold has always been a good way to keep your money safe when prices go up. Having gold coins. Investing in gold may provide investors with a hedge against inflation and economic uncertainty. It can also diversify an investment portfolio, reducing.

Holding bars and coins can have downside, though. For one, investors often pay a premium over the metal spot price on gold and silver coins because of. Since gold coins were first struck in around BC, they formed an important foundation to our monetary system. However, treasures containing gold have been. Holding value in the long term, remarkable purity, and a variety of sizes, gold bars are a strong choice for investors. Cons of Buying Gold Bullion Bars. Okay. "Bullion coins are an attractive option for many investors looking to diversify their investment portfolio,” Andrew Dickey, director of precious metals at the. We believe that you should invest in both gold coins and gold bars. This is the best way to hedge your bets, spread your risks, and diversify your portfolio. The safest way to buy gold, silver and platinum bullion is direct from one of the world's leading mints, The Perth Mint. Explore gold buying options. This allows gold and silver bullion to act as both a safe haven investment and a safe haven currency. Hedge - Gold and silver bullion are invested in by. carat gold bullion coins, which are generally thought to be more durable as they contain added metals such as copper or silver, are also popular investment. The premium is one of the biggest factors to consider when choosing between gold bars or coins. At smaller size investments however, particularly 1oz and under. Gold coins are also a great way to invest in physical gold. Nowadays, most of the Government Mints produce gold bullion coins for investment purpose. The. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. It can Protect Against Inflation Risks · A Good Way to Save Money for Future · Easy to Buy and Very Easy to Sell in the Market · Does not Require Much Maintenance. Over the years, your money is worth more in gold coins, than in the bank. Experienced Investors. In addition to the benefits for first time investors. Several people even consider gold coins as an alternative to currency, especially when the value of a currency is low in the market. Investing in gold is. Take into account their aesthetic value and historical significance, and these coins can offer the best potential rise in numismatic value for close to bullion. Buying physical gold coins and bars comes with plenty of benefits. The two main benefits of investing in gold is to protect and preserve your wealth, as well as. Gold bullion and silver bullion both offer worthwhile, dependable and reassuring investments. Bullion is tangible, easily traded and unlike ETFs or shares. Investors often see gold as a 'safe haven' during periods of uncertainty, but all sorts of factors can have an impact on its price. These include supply and. Consumers Should Do Their Homework Before Investing in Gold Coins For much of human civilization, gold has ignited the imagination of investors. There are some additional costs to owning physical gold. The most common of these is safe storage – many investors keep their gold bullion with the bank safety.

American Century High Yield Muni

American Century CA High Yield Muni Inv BCHYX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio %. American Century Municipal Trust - High-Yield Municipal Fund is an open-ended fixed income mutual fund launched and managed by American Century Investment. Designed to provide shareholders with a high level of California and federal tax-free income while maintaining low exposure to the alternative minimum tax. Get the latest American Century High Yield Municipal Fund Investor Class (ABHYX) stock price quote with financials, statistics, dividends, charts and more. American Century CA Hi-Yield Muni I (BCHIX). Cat: Muni Bond; Type: No Load; Min. Invest: $5M; Exp. Ratio: %. 91 "Excellent". Sub-MAXratings. The American Century High-Yield Muni Inv fund (ABHYX) is a High Yield Muni fund started on 03/31/ and has $ million in assets under management. Investment Policy. The Fund seeks to provide a high current income exempt from federal income taxes, with capital appreciation as a secondary objective. performance of any American Century Investments portfolio. Statements Index and the S&P Municipal Bond California High Yield Index to achieve a The fund invests at least 80% of its net assets in municipal securities with income payments exempt from federal and California income taxes. American Century CA High Yield Muni Inv BCHYX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio %. American Century Municipal Trust - High-Yield Municipal Fund is an open-ended fixed income mutual fund launched and managed by American Century Investment. Designed to provide shareholders with a high level of California and federal tax-free income while maintaining low exposure to the alternative minimum tax. Get the latest American Century High Yield Municipal Fund Investor Class (ABHYX) stock price quote with financials, statistics, dividends, charts and more. American Century CA Hi-Yield Muni I (BCHIX). Cat: Muni Bond; Type: No Load; Min. Invest: $5M; Exp. Ratio: %. 91 "Excellent". Sub-MAXratings. The American Century High-Yield Muni Inv fund (ABHYX) is a High Yield Muni fund started on 03/31/ and has $ million in assets under management. Investment Policy. The Fund seeks to provide a high current income exempt from federal income taxes, with capital appreciation as a secondary objective. performance of any American Century Investments portfolio. Statements Index and the S&P Municipal Bond California High Yield Index to achieve a The fund invests at least 80% of its net assets in municipal securities with income payments exempt from federal and California income taxes.

American Century CA High Yield Muni Y (ACYHX) is an actively managed Municipal Bond Muni California Long fund. American Century Investments launched the fund in. American Century High-Yield Muni C (AYMCX). Categories. High Yield» Muni». Family. American Century Investments». Issue, Coupon, Maturity Date, Amount Owned. ABHYX: American Century High-Yield Municipal Fund Investor Class - Fund Profile. Get the lastest Fund Profile for American Century High-Yield Municipal Fund. Complete American Century High-Yield Municipal Fund;C funds overview by Barron's. View the AYMCX funds market news. The fund invests in municipal and other debt securities with an emphasis on high-yield securities. Under normal market conditions, the portfolio managers. High Yield Municipal Fund [ABHYX] is traded in USA and was established 1st of June High-yield Municipal is listed under American Century Investments. Get AYMAX mutual fund information for American-Century-High-Yield-Municipal-Fund-Class-A, including a fund overview,, Morningstar summary, tax analysis. American Century High-Yield Muni Inv (ABHYX) is an actively managed Municipal Bond High Yield Muni fund. American Century Investments launched the fund in Objective. The investment seeks high current income that is exempt from federal and California income taxes. The fund invests at least 80% of its net assets in. A high-level overview of American Century California High Yield Municipal Fund I Class (BCHIX) stock. Stay up to date on the latest stock price, chart. The investment seeks high current income that is exempt from federal income tax; capital appreciation is a secondary consideration. View Top Holdings and Key Holding Information for American Century High-Yield Muni Inv (ABHYX). See American Century High-Yield Municipal Fd (AYMAX) mutual fund ratings from all the top fund analysts in one place. See American Century High-Yield. Morningstar Category: High-Yield Muni portfolios typically invest a substantial portion of assets in high-income municipal securities that are not rated or. This informs our views on duration, yield curve positioning and allocations to high-yield municipal bond Diagram showing American Century's muni portfolio. Performance charts for American Century High-Yield Municipal Fund (ABHYX) including intraday, historical and comparison charts, technical analysis and trend. AMERICAN CENTURY CALIFORNIA HIGH YIELD MUNICIPAL FUND A CLASS- Performance charts including intraday, historical charts and prices and keydata. • California High-Yield Municipal. • California Intermediate-Term Tax-Free Please consult your tax advisor. American Century Investment Services, Inc. BCHYX | A complete American Century California High-Yield Municipal Fund;Investor mutual fund overview by MarketWatch. View mutual fund news. Prior to joining American Century Investments, he was an assistant portfolio manager at Franklin Templeton Investments for seven years. He has a bachelor's.

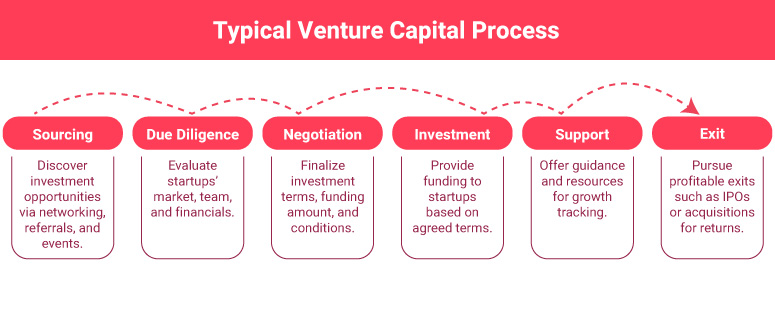

What Is Vc Investor

Venture capital is a form of investment in early-stage companies with strong growth potential. The types of businesses venture capital funds invest in tend to. NVCA is a nonprofit association powered by our members. We convene venture capital investors, entrepreneurs, and industry partners to shape public policy. A deep dive into venture capital — equipping you with the frameworks needed to drive investment decisions for early-stage startups. This article delves into three areas in particular that new venture investors should look to understand. Venture capital, a form of investment that focuses on early-stage, innovative businesses with strong growth potential, could be a good next step. Venture capital (VC) is a key engine for growth in the US economy. It has financed juggernauts such as Hewlett-Packard, Microsoft, and Apple. Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to. The Global Ranking is what it sounds like. A ranking of venture capital investors, based anywhere, investing in companies anywhere, and at any stage. The. A unique institutional investor asset class. Venture capitalists create partnerships with pension funds, endowments, foundations, and others to make high-risk. Venture capital is a form of investment in early-stage companies with strong growth potential. The types of businesses venture capital funds invest in tend to. NVCA is a nonprofit association powered by our members. We convene venture capital investors, entrepreneurs, and industry partners to shape public policy. A deep dive into venture capital — equipping you with the frameworks needed to drive investment decisions for early-stage startups. This article delves into three areas in particular that new venture investors should look to understand. Venture capital, a form of investment that focuses on early-stage, innovative businesses with strong growth potential, could be a good next step. Venture capital (VC) is a key engine for growth in the US economy. It has financed juggernauts such as Hewlett-Packard, Microsoft, and Apple. Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to. The Global Ranking is what it sounds like. A ranking of venture capital investors, based anywhere, investing in companies anywhere, and at any stage. The. A unique institutional investor asset class. Venture capitalists create partnerships with pension funds, endowments, foundations, and others to make high-risk.

Venture capital (VC) is a form of financing where capital is invested into a company—a startup or small business—in exchange for equity in the company. To. Features of Venture Capital · The tenure of investments is usually long-term in cases of VC financing. · Venture capital firms invest in projects that exhibit. Venture Capitalist vs. Angel Investor: What's the difference? Venture capitalists are business professionals who invest money into startups on behalf of a risk. Learn about venture capital (VC) funding, decide whether it's right for your business, and learn how to put your best foot forward when seeking VC funding. Venture capital is a form of capital to support startups and other businesses with the potential for substantial and rapid growth. Use a tool like PitchBook or Capital IQ to find which firms are investing in your sector at your stage. A venture partner is a valuable asset in the world of venture capital, often acting as a bridge between the venture capital (VC) firm and their portfolio. We talked to founders and investors about why fit matters. Here's their advice on what startups should look for in a VC, how to approach first meetings. A VC Principal will be responsible for the vast majority of the daily running of the investment operations and assist partners by doing all the early stage work. Venture capital (VC) is a key engine for growth in the US economy. It has financed juggernauts such as Hewlett-Packard, Microsoft, and Apple. VC stands for Venture Capitalist, the person you meet and who is going to give you money. We also call this person a GP = General Partner. What you should know: · Venture capital is a form of private equity financing that helps start and grow new businesses. · Venture capital investing comes with a. The CVCA defines venture capital as investments in early-stage companies, mostly in the technology sector. Venture capital and angel investments offer excellent options to startup businesses. Outside of choices like securing a bank loan or public offerings. Venture capital is a type of private equity investing that involves investment in earlier-stage businesses that require capital. In return, the investor will. Key Highlights · Venture capital firms make private equity investments in disruptive companies with high potential returns over a long time horizon. · The three. In this article we'll go over the need-to-knows about early stage VC; pre-seed, seed & series A funding and how you can prepare to pitch to investors. With the relaxation of the “prudent man rule” in , pension funds were allowed to allocate up to 10% of their capital to VC funds. As a result, a large and. Venture capital (VC) managers aim to invest in startup companies that are early in the development stage - often pre-profit - with high growth potential. They. A VC Principal will be responsible for the vast majority of the daily running of the investment operations and assist partners by doing all the early stage work.

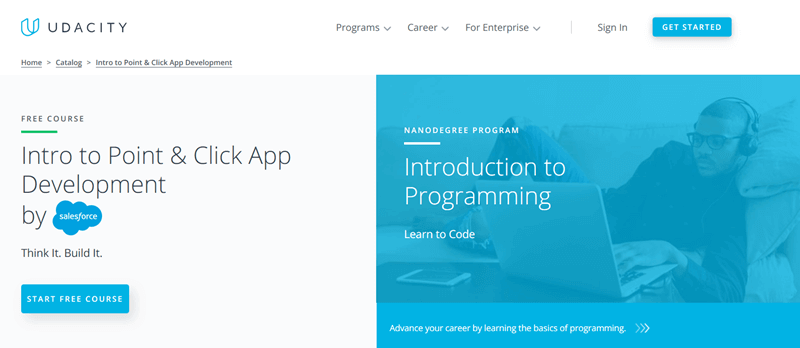

Udacity Or Udemy

Udacity has more exercises and more practice than most Udemy courses, but their classes are full of bells and whistles. Imagine a programming course where the. The best overall Udacity alternative is Pluralsight Skills. Other similar apps like Udacity are LinkedIn Learning, Udemy Business, DataCamp, and QA USA. Udacity. Udemy offers a wide variety of courses, while Udacity focuses on specialized programs that target specific career paths. Regardless of which. With more than + online training courses, Udemy Business is a global learning solution that helps you drive business outcomes. As everyone keeps saying, Udemy has better quality than Udacity at a fraction of the cost ($10 total Vs. $ a month), they have more/better. Udacity rates % higher than Udemy on Team Culture Ratings vs Udemy Ratings based on looking at ratings from employees of the two companies. Ratings come. Udemy has many creative and programming courses, whereas Udacity focuses more on quality content. You can learn a wider range of creative skills and practical. Most Prefer Udemy to Udacity in Find Out Why! · Udacity Offers + Courses – Udemy Has ,+ · Udacity Is Simple to Use – Udemy Has Better Course. In this article, you'll find a thorough Udemy VS Udacity comparison that will help you to decide which of the two online learning platforms is right for you. Udacity has more exercises and more practice than most Udemy courses, but their classes are full of bells and whistles. Imagine a programming course where the. The best overall Udacity alternative is Pluralsight Skills. Other similar apps like Udacity are LinkedIn Learning, Udemy Business, DataCamp, and QA USA. Udacity. Udemy offers a wide variety of courses, while Udacity focuses on specialized programs that target specific career paths. Regardless of which. With more than + online training courses, Udemy Business is a global learning solution that helps you drive business outcomes. As everyone keeps saying, Udemy has better quality than Udacity at a fraction of the cost ($10 total Vs. $ a month), they have more/better. Udacity rates % higher than Udemy on Team Culture Ratings vs Udemy Ratings based on looking at ratings from employees of the two companies. Ratings come. Udemy has many creative and programming courses, whereas Udacity focuses more on quality content. You can learn a wider range of creative skills and practical. Most Prefer Udemy to Udacity in Find Out Why! · Udacity Offers + Courses – Udemy Has ,+ · Udacity Is Simple to Use – Udemy Has Better Course. In this article, you'll find a thorough Udemy VS Udacity comparison that will help you to decide which of the two online learning platforms is right for you.

Udacity is an open-host learning platform (just like Udemy), but the instructors are hand-picked and are experts and renowned in the digital and technical world. Coursera, EdX, Udacity and Udemy have courses from providers such as Harvard, Microsoft and Google. Which courses are available for beginners? (Jump to see all. Founded in , Udemy is an online learning platform—the same genre as platforms like edX, Coursera, Udacity, and Khan Academy—but with a twist. Most online. Why Choose edX over Udemy? edX's courses are partnered with top academic institutions, which means the instructors teaching its learning programs are from these. Udacity offers just over courses on its platform, but this is to be expected as Udacity doesn't have as many courses as Udemy. Udemy focuses on a vast set of topics like Photography, Cooking, Marketing and so on. · Udemy offers courses at a price much lower than Udacity. Udemy scored higher in 8 areas: Overall Rating, Culture & Values, Senior Management, Compensation & Benefits, Career Opportunities, CEO Approval, Recommend to a. Comparing the customer bases of Udemy and Udacity, we can see that Udemy has 12, customer(s), while Udacity has customer(s). In the Learning Management. Now, when it comes to the Coursera VS Udacity comparison, I have both good and bad news. Udacity provides certified courses, however, certificates are not. Free courses from Udemy to help you make the most of your time, from working at home to trending technical skills and self-improvement, wherever you are. Udacity is better for those focused on a career in digi-tech, whereas Udemy is best for those looking for a wider range of course categories. In this article, I'll compare the four most popular learning platforms: Udemy, Coursera, Udacity, and Edx, and evaluate which provides better courses in Udemy vs. Udacity: What's the Difference? and Sea Breeze with list of top differences and real time examples including images, dog, cat, gross, net, java. Compare Udacity vs. Udemy using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best choice for your. Udemy offers shorter, less expensive courses on a wide range of topics that anyone can produce. Udacity provides more extended Nanodegree programs in. For courses, Udemy is hit or miss unfortunately. I wish there was an explicit way to tell before buying the course whether it allowed downloading the material . Udemy has a range of content. When you explore the content broadly, there are 13 categories: development, business, finance and accounting, IT and software. Compare Scaler Academy vs. Udacity vs. Udemy vs. WileyPLUS using this comparison chart. Compare price, features, and reviews of the software side-by-side to. While Udemy has many web development courses, not all of them are updated with the latest information. If you are looking for an introductory course to get a. Udemy Vs Udacity Vs Coursera Online Courses Compared☆☛✓Udemy Vs Udacity. Udacity Vs Udemy. Find out more - Coursera or edX or Udacity certificates.

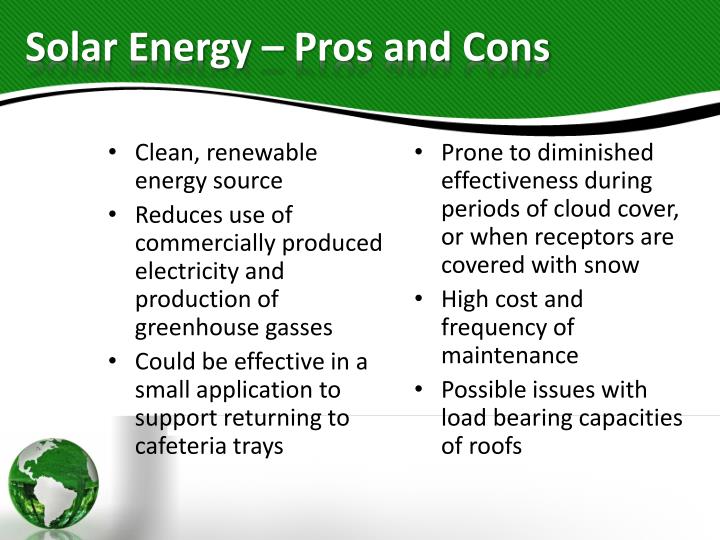

Going Solar Pros And Cons

There are a variety of financial incentives available, such as tax rebates and state policies, that help make going solar affordable for more families. There. The first is the cost savings offered by going solar. Solar reduces, and in some cases, eliminates, a property's reliance on fossil fuel-based grids –. Pros: eventually pays for itself in "free" power, and excess production sold to the grid - a consideration with current energy costs Cons: expensive to. Although going off-grid reduces your monthly energy bill, off-grid solar requires a larger initial investment than grid-tied solar. · Off-grid solar projects. Top pros and cons of solar energy ; 1. It lowers your electric bills, 1. It doesn't work for every roof ; 2. It can improve your home value, 2. It might not be. There are several appealing advantages of solar energy that draw in consumers. They are widely available, increasingly versatile, and can offer significant. Solar energy systems can generate electricity in any climate. One of the disadvantages of solar energy is that it's subject to temporary weather disruption. The Top 11 Pros and Cons of Solar Energy ; Reduces your carbon footprint, Solar installations can be expensive ; Saves money on your electricity bills, Doesn't. Pros of Going Solar in · The cost of solar is expected to fall in · Solar is a hedge against energy inflation · Solar energy is much cleaner than fossil. There are a variety of financial incentives available, such as tax rebates and state policies, that help make going solar affordable for more families. There. The first is the cost savings offered by going solar. Solar reduces, and in some cases, eliminates, a property's reliance on fossil fuel-based grids –. Pros: eventually pays for itself in "free" power, and excess production sold to the grid - a consideration with current energy costs Cons: expensive to. Although going off-grid reduces your monthly energy bill, off-grid solar requires a larger initial investment than grid-tied solar. · Off-grid solar projects. Top pros and cons of solar energy ; 1. It lowers your electric bills, 1. It doesn't work for every roof ; 2. It can improve your home value, 2. It might not be. There are several appealing advantages of solar energy that draw in consumers. They are widely available, increasingly versatile, and can offer significant. Solar energy systems can generate electricity in any climate. One of the disadvantages of solar energy is that it's subject to temporary weather disruption. The Top 11 Pros and Cons of Solar Energy ; Reduces your carbon footprint, Solar installations can be expensive ; Saves money on your electricity bills, Doesn't. Pros of Going Solar in · The cost of solar is expected to fall in · Solar is a hedge against energy inflation · Solar energy is much cleaner than fossil.

The long-term economic advantages of solar energy cannot hide the fact that the high initial investment is still the major obstacle. A high initial expenditure. Solar power is generated by capturing the sun's energy, making it completely clean. Rather than burning fossil fuels and producing greenhouse gas emissions, you. Solar energy produces no air or water pollution or greenhouse gases. However, it has some indirect impacts on the environment. For example, the manufacturing of. How much do solar panels cost is probably the number one question our potential clients ask us on a daily basis. From permitting (in some areas) to project. What are the advantages and disadvantages? ; Renewable Energy Source, Cost ; Reduces Electricity Bills, Weather Dependent ; Diverse Applications, Solar Energy. Pros: eventually pays for itself in "free" power, and excess production sold to the grid - a consideration with current energy costs Cons: expensive to. What Are The Benefits of Going Solar? · Electricity Bill Savings · Home Resale Value Increase · Clean, Renewable Energy. Will I save money going solar? · The amount of money you can save with solar depends upon how much electricity you consume, the size of your solar energy system. Switching to solar energy for your home can be a game-changer, but like any decision, it comes with its pros and cons. Let's dive into both the. Going Local Saves You Money Solar isn't cheap, due mainly to the high cost of purchase and installation. However, it's well known that having a home solar. Pros and Cons of Solar Panels for the Home · Installation and maintenance costs are still high. · Solar only works when the sun is out and on certain types of. Solar power is generated by capturing the sun's energy, making it completely clean. Rather than burning fossil fuels and producing greenhouse gas emissions, you. Solar energy is sustainable, renewable, and plentiful. As the cost of using solar to produce electricity goes down each year, many Americans are. One of the most immediate and appealing benefits of transitioning to solar energy is the potential for substantial cost savings. While the upfront investment. Solar energy is a long-term investment. Your system can take a few years to generate enough electricity to fully pay for itself. But once it does, it generates. If a solar panel system's payback period is years or less, going solar is worth it and will likely provide a good return on investment. In states with high. Pros of Solar Energy · 1. Renewable Energy Source · 2. Environmentally Friendly · 3. Reduced Electricity Bills · 4. Tax Credits and Net Metering · 5. Increased Home. By switching to solar power, you reduce your carbon footprint and contribute to the global effort to combat climate change. Solar energy. 2) The upfront cost of going solar can be quite expensive According to some estimates, the average cost to invest in a solar system is around $29,, and for. You can reduce your electric bill with energy costs on the rise, installing a solar panel system is an excellent way to save on your monthly power bills.

Compare Betterment And Wealthfront

Wealthfront vs Betterment ; Pros: Minimal opening deposit & fees; Advanced goal tracker; Tax loss harvesting. Cons: No human advisors; No fractional shares ; Pros. Have you ever written an article comparing Wealthfront vs Betterment? If not, what do you think are the main differences and how can i decide which one to use? If you prefer scheduling meetings and talking to someone on the phone and don't mind paying higher fees to do so, Betterment may be the better choice. One glaring difference between Wealthfront and Betterment is that Betterment offers personalized financial planning with unlimited support from Certified. Wealthfront charges no fees on accounts under $10k, and % over $10k. Betterment charges % on accounts under $10k with minimum $/mo auto-deposit, Have you ever written an article comparing Wealthfront vs Betterment? If not, what do you think are the main differences and how can i decide which one to use? An automated investing throw-down: when choosing between Betterment and Wealthfront, there's a lot to consider. After testing each platform extensively, here. Betterment has a wider variety of pre-built portfolios, no account minimums, and you can get access to a human advisor. Betterment seems to win in several aspects: minimum deposits, fees, human assistance, and fractional shares. Wealthfront vs Betterment ; Pros: Minimal opening deposit & fees; Advanced goal tracker; Tax loss harvesting. Cons: No human advisors; No fractional shares ; Pros. Have you ever written an article comparing Wealthfront vs Betterment? If not, what do you think are the main differences and how can i decide which one to use? If you prefer scheduling meetings and talking to someone on the phone and don't mind paying higher fees to do so, Betterment may be the better choice. One glaring difference between Wealthfront and Betterment is that Betterment offers personalized financial planning with unlimited support from Certified. Wealthfront charges no fees on accounts under $10k, and % over $10k. Betterment charges % on accounts under $10k with minimum $/mo auto-deposit, Have you ever written an article comparing Wealthfront vs Betterment? If not, what do you think are the main differences and how can i decide which one to use? An automated investing throw-down: when choosing between Betterment and Wealthfront, there's a lot to consider. After testing each platform extensively, here. Betterment has a wider variety of pre-built portfolios, no account minimums, and you can get access to a human advisor. Betterment seems to win in several aspects: minimum deposits, fees, human assistance, and fractional shares.

Employees at Betterment rate their Perk and Benefits Score a 76/, with Engineering as the department that rate their experience the highest. Betterment invests your money through fractional shares — tiny portions of equity that aren't a full stock or bond. That means all your money is invested from. Wealthfront isn't the only famous robo-advisor that's big on ETFs, though. The competition is fierce, and Betterment has an arguably more dominant position in. Betterment's Tax Coordination is a bigger value than Wealthfront's focus on tax strategies like direct indexing. It is more valuable because it. Wealthfront's stock-level tax-loss harvesting gives it a significant advantage over Betterment when it comes to tax-loss harvesting. One of the reasons is the. Wealthfront's stock-level tax-loss harvesting gives it a significant advantage over Betterment when it comes to tax-loss harvesting. One of the reasons is the. Wealth front and Betterment are upsetting financial services by providing the masses with automated versions of sophisticated investment. Betterment and Wealthfront both use well-designed asset allocation strategies. They invest money into exchange traded funds (ETFs), but there are a few. Betterment is based in New York and was founded by Jon Stein in They currently have roughly $14 billion of assets under management. Wealthfront and Betterment have led the robo-advisor industry for over a decade. However, alphaAI is now challenging the traditional buy-and-hold. Betterment and Wealthfront have a slightly different asset allocation based on their risk assessment of me (Wealthfront choose a portfolio with 9% bonds. Betterment and Wealthfront both have their advantages, but I'd recommend most people start out with Betterment for these 5 reasons. Choosing the best robo-advisor for your needs can be challenging. We compare fees, features and funds to help you decide Wealthfront. Wealthfront. Forbes. Betterment and Wealthfront both charge an annual fee of % for digital portfolio management. The differences between these two big robo-advisors largely. Betterment and Wealthfront have a slightly different asset allocation based on their risk assessment of me (Wealthfront choose a portfolio with 9% bonds. When it comes to features, both Betterment and Wealthfront are impressive. But each service has a few differences in what they offer. If you want to leverage. Betterment's first landing page highlights the differences between Schwab and Betterment This is interesting, considering that many people compare Betterment. Comparing Robo-Advisors: Digit, Acorns, Betterment, Wealthfront. by Jasmin Sethi, Megan However, if you were to compare them to the more established. Betterment and Wealthfront have a slightly different asset allocation based on their risk assessment of me (Wealthfront choose a portfolio with 9% bonds. Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long.

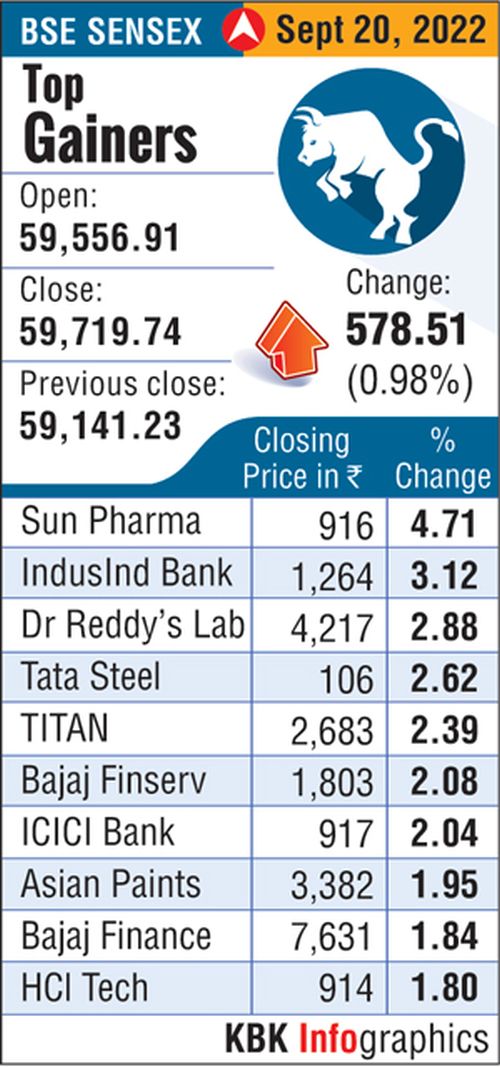

Biggest Stock Gainers Today Us

Discover the top-performing US stocks across various sectors. Gain direct access to over + high-performing stocks and track all your investments on one. Today's Top Movers · Q32 Bio Inc. QTTB. Price: $ Daily change: N/A · Instil Bio Inc TIL. Price: $ Daily change: N/A · Lexaria Bioscience Corp LEXX. No. Symbol, Company Name, % Change, Stock Price, Volume, Market Cap. 1, BOF, BranchOut Food Inc. %, , ,,, M. 2, SGRP, SPAR Group. The top gaining stocks today in the USA (Nasdaq and NYSE exchanges). These are the stocks making the largest advance in the current or last trading session. Stock Movers ; Intchains Group Ltd. ADR (ICG) · Intchains Group Ltd. ADR (ICG). K · , , ; Theriva Biologics Inc. (TOVX) · Theriva Biologics Inc. NYSE Largest % Price Gain ; BERZ · BERZ · MicroSectors FANG & Innovation -3x Inverse Leveraged ETN. $ ; FOA · FOA · Finance of America Cos. Inc. $ ; TCS. TOP GAINERS ; WDC · Western Digital Corp. , % ; TSLA · Tesla Inc. , % ; AVGO · Broadcom Inc. , %. Biggest Stock Gainers Today (TOP 50 LIST) ; AGMH, AGM Group, ; RILY, B. Riley Financial, ; ASPU, Aspen, ; RAIL, FreightCar America, Top Stock Gainers Today ; INTC. Intel. $, $ ; BMA. Banco Macro SA. $, $ ; MRVL. Marvell. $, $ ; AFRM. Affirm Holdings. $, $ Discover the top-performing US stocks across various sectors. Gain direct access to over + high-performing stocks and track all your investments on one. Today's Top Movers · Q32 Bio Inc. QTTB. Price: $ Daily change: N/A · Instil Bio Inc TIL. Price: $ Daily change: N/A · Lexaria Bioscience Corp LEXX. No. Symbol, Company Name, % Change, Stock Price, Volume, Market Cap. 1, BOF, BranchOut Food Inc. %, , ,,, M. 2, SGRP, SPAR Group. The top gaining stocks today in the USA (Nasdaq and NYSE exchanges). These are the stocks making the largest advance in the current or last trading session. Stock Movers ; Intchains Group Ltd. ADR (ICG) · Intchains Group Ltd. ADR (ICG). K · , , ; Theriva Biologics Inc. (TOVX) · Theriva Biologics Inc. NYSE Largest % Price Gain ; BERZ · BERZ · MicroSectors FANG & Innovation -3x Inverse Leveraged ETN. $ ; FOA · FOA · Finance of America Cos. Inc. $ ; TCS. TOP GAINERS ; WDC · Western Digital Corp. , % ; TSLA · Tesla Inc. , % ; AVGO · Broadcom Inc. , %. Biggest Stock Gainers Today (TOP 50 LIST) ; AGMH, AGM Group, ; RILY, B. Riley Financial, ; ASPU, Aspen, ; RAIL, FreightCar America, Top Stock Gainers Today ; INTC. Intel. $, $ ; BMA. Banco Macro SA. $, $ ; MRVL. Marvell. $, $ ; AFRM. Affirm Holdings. $, $

Stock Screener Stock Ideas Today's Top Gainers. Biggest Stock Gainers Today (Top Market Gainers). The stocks with the largest increases in price today on the. Top gaining US stocks in post-market ; LGMK · D · +%, USD ; CLOV · D · +%, USD ; CNFR · D · +%, USD ; ATRA · D · +%, USD. Discover top US stocks surging right now with Webull's real-time gainers list. Track hot companies & make informed trades. Biggest Stock Gainers This Week ; Quantum Co. stock logo. QMCO. Quantum. $ +1,%, $ ; BranchOut Food Inc. stock logo. BOF. BranchOut Food. $ +. U.S. Stock Movers ; Intel Corp. (INTC) · Intel Corp. (INTC). M · ; Verve Therapeutics Inc. (VERV) · Verve Therapeutics Inc. (VERV). M · ; Marvell. Stock movers ; HBM-T · Hudbay Minerals Inc, ; SJ-T · Stella Jones Inc, ; CJT-T · Cargojet Inc, ; FM-T · First Quantum Minerals Ltd, The top gaining stocks today in the USA (Nasdaq and NYSE exchanges). These are the stocks making the largest advance in the current or last trading session. Top stock gainers today ; Fees. $0. per online equity trade. Fees. $0. per trade. Fees. $0 ; Account minimum. $0. Account minimum. $0. Account minimum. $0. The following is a list of the stocks that have the biggest percentage gains on the day. This list includes the companies with above average volume trading. S&P - Top Gainers ; Church & Dwight, , ; Campbell Soup, , ; Southern, , ; American. The stocks below are today's top S&P gainers based on yesterday's close and the current price (or the most recent closing price). Stock Market Trading Activity ; TSLA, , +, +%, M. Top Gainers - United States Stocks. The Top Gainers Today is a tool that provides real-time information on the top-gaining stocks in the US market today. This product is designed to help. NASDAQ - Top Gainers ; American Electric Power, , ; Copart, , ; Exelon, , ; Old. Gainers ; $ + (%). Mil. Mil. Post-Trading. ; $ + (%). , , Post-Trading. Week Gainers ; 1, MTNB, Matinas BioPharma Holdings, Inc. ; 2, BOF, BranchOut Food Inc. ; 3, WOK, WORK Medical Technology Group LTD ; 4, SGLY, Singularity Future. Market: US. Canada. UK. Australia. Europe. HOME. Stocks. Market Pulse. Stock Market Overview Market Momentum Market Performance Top Stocks Today's Price. Biggest Stock Gainers Today ; YIBO. Planet Image International. $ +%, $ ; Cloopen Group Holding Limited stock logo. RAAS. Cloopen Group. $ +%. Top Gainers Today. Discover which U.S. (NYSE and NASDAQ) stocks have gained the most from the previous trading day.

Certified Banking Auditor

The Certified Bank Auditor (CBA) is a prestigious designation offered by the Bank Administration Institute (BAI) designed for professionals in the banking. The Certified Internal Auditor® (CIA®) designation is the only globally accepted certification for internal auditors and remains the standard by which. The Certification for Bank Auditors (CBA) is designed for bankers willing to achieve greater experience and insights in the field of Internal Auditing. IIA-CFSA-BANK Certified Financial Services Auditor - Banking] The IIA-CFSA-BANK Certified Financial Services Auditor - Banking Practice Course is an. The self-study program gives professionals a clear understanding of audit principles, and the judgement needed to evaluate financial crime risk controls and. The Institute of Internal Auditors offers the Certified Internal Auditor (CIA) designation to college graduates who have worked for two years as internal. The Certified Financial Services Auditor® (CFSA®) certification demonstrates the skills necessary to work in banking institutions, thrift/savings and loan. Earning a CBA without undergraduate education requires six years of industry practice in bank and internal auditing. All applicants must possess a minimum of. This certificate program is designed for chief audit executives, internal audit managers, senior and staff auditors, and consulting associates. The Certified Bank Auditor (CBA) is a prestigious designation offered by the Bank Administration Institute (BAI) designed for professionals in the banking. The Certified Internal Auditor® (CIA®) designation is the only globally accepted certification for internal auditors and remains the standard by which. The Certification for Bank Auditors (CBA) is designed for bankers willing to achieve greater experience and insights in the field of Internal Auditing. IIA-CFSA-BANK Certified Financial Services Auditor - Banking] The IIA-CFSA-BANK Certified Financial Services Auditor - Banking Practice Course is an. The self-study program gives professionals a clear understanding of audit principles, and the judgement needed to evaluate financial crime risk controls and. The Institute of Internal Auditors offers the Certified Internal Auditor (CIA) designation to college graduates who have worked for two years as internal. The Certified Financial Services Auditor® (CFSA®) certification demonstrates the skills necessary to work in banking institutions, thrift/savings and loan. Earning a CBA without undergraduate education requires six years of industry practice in bank and internal auditing. All applicants must possess a minimum of. This certificate program is designed for chief audit executives, internal audit managers, senior and staff auditors, and consulting associates.

CERTIFICATIONS & DESIGNATIONS · Why Become, or Hire Certified Auditors? · Benefits and Competencies of a Certified Auditor · AAC Auditor Certification Designations. Auditing for Financial Institutions (CIAFIN) (Certified Bank Auditor) certifications within 5 years from the effective date of: 1 January , for existing. Achieving a CISA certification showcases your expertise and asserts your ability to apply a risk-based approach to audit engagements. Addressing innovations. Enhance the expertise of the Chartered Accountant in Internal Audit. Build Governance, Risk and Compliance as one of their core competencies. Help certified. To earn the Certified Community Bank Internal Auditor (CCBIA) certification, you will be required to attend the Audit Institute in its entirety. Certified Professionals are also experts in the subjects like forensic auditing related to banking sector, litigation support and investigative accounting. This. Internal Auditors and Compliance Officers who complete the Electronic Banking Internal Audit Certification Program earn a prestigious designation awarded by. The Certified Quality Auditor is a professional who understands the standards and principles of auditing and the auditing techniques of examining, questioning. This program is designed to equip audit professionals in banking institutions with the knowledge and skills required for auditing banking operations, regulatory. To be eligible, you must have a bachelor's degree and two years of bank auditing experience, or a bachelor's degree and master's degree in accounting or. The Financial Services Audit Certificate is designed to enhance specialized knowledge and showcase expertise in 11 key areas. Learn more. If you currently hold. All organizations who conduct anti-financial crime audits will benefit from having CAMS-Audit qualified leaders. This includes: · Banks · Non-bank financial. The Certified Financial Services Auditor (CFSA) credential from the Institute of Internal Auditors (IIA) is available for auditors who work in banking. Certifications. Obtain a nationally recognized designation in areas including wealth management and trust, compliance, risk management and bank marketing. CIA certification, offered by the Institute for Internal Auditors (IIA), demonstrates expertise in all areas of auditing. Candidates for the CIA credential must. ISO certification is gaining importance in the world of financial operations. The GSDC ISO Lead Auditor certification verifies expertise in this. Lenaire Harrison Earns Designation as Certified Bank Auditor. The CBA certification, awarded by Bankers Administration Institute (BAI), is a nationally. Certified Bank Forensic Accountant (CBFA) is a banker, bank audit, professional or a consultant who has undergone training to become an expert in the domain of. The Certification for Bank Auditors (CBA) is a credential for bankers who want to advance their status and authority in internal auditing. The CBA curriculum is.

New Lows In The Stock Market

Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40, All - Get the latest stock market news, stock information and charts, data analysis reports, as well as a general overview of the market landscape from. The New Week High/Low indicates a stock is trading at its highest or lowest price in the past 52 weeks. This is an important indicator for many investors. These include U.S. Crude Oil (/CL) futures touching nearly three-year lows below $66 per barrel, 2-year Treasury note yields hitting a new week low, and. The current month is updated on an hourly basis with today's latest value. The current price of the Dow Jones Industrial Average as of September 09, is. Dow Jones Industrial 2folks.ru:Dow Jones Global Indexes · Open40, · Day High40, · Day Low40, · Prev Close40, · 52 Week High41, · The New Highs - New Lows indicator (NH-NL) displays the daily difference between the number of stocks reaching new week highs and the number of stocks. New 52 Week High/Low ; ABINFRA, SM, ; AEROFLEX, EQ, ; AETHER, EQ, 1, ; AISL, SM, NEW LOWS ; Intel Corp. ; NetEase Inc. ADR, ; GlobalFoundries Inc. ; Sirius XM Holdings Inc. ; Chesapeake Energy Corp. Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40, All - Get the latest stock market news, stock information and charts, data analysis reports, as well as a general overview of the market landscape from. The New Week High/Low indicates a stock is trading at its highest or lowest price in the past 52 weeks. This is an important indicator for many investors. These include U.S. Crude Oil (/CL) futures touching nearly three-year lows below $66 per barrel, 2-year Treasury note yields hitting a new week low, and. The current month is updated on an hourly basis with today's latest value. The current price of the Dow Jones Industrial Average as of September 09, is. Dow Jones Industrial 2folks.ru:Dow Jones Global Indexes · Open40, · Day High40, · Day Low40, · Prev Close40, · 52 Week High41, · The New Highs - New Lows indicator (NH-NL) displays the daily difference between the number of stocks reaching new week highs and the number of stocks. New 52 Week High/Low ; ABINFRA, SM, ; AEROFLEX, EQ, ; AETHER, EQ, 1, ; AISL, SM, NEW LOWS ; Intel Corp. ; NetEase Inc. ADR, ; GlobalFoundries Inc. ; Sirius XM Holdings Inc. ; Chesapeake Energy Corp.

New 52 Week High/Low ; ABINFRA, SM, ; AEROFLEX, EQ, ; AETHER, EQ, 1, ; AISL, SM, Investors should also be aware that If the market is trending strongly, the high-low index can give extreme readings for a prolonged period. Trading with the. The New York Stock Exchange (NYSE) is a physical exchange, with a hybrid market when it is low." A stock market crash is often defined as a. Provided by Dow Jones Sep 10, pm. MarketWatch · Meta is one of the cheapest big tech stocks, and that earns it a new 'buy' call. Provided by Dow Jones. New Stock Week Highs & Lows. Report Date: 6-Sep New Week Highs· New Week Lows. Search: Today's New Week Highs. US Markets: Get the complete US Stock Markets coverage with latest news (%). Show More. 52 Week High. High; Low. Name, Price Change. IBM. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. Stock market today: Tech leads S&P, Nasdaq higher as bank stocks drag on Dow Investors are gearing up for a consumer inflation print seen as crucial to. Stock Quote. NYSE: ONON. Price. $ Change. Volume. 5, % Change. %. Intraday High. $ 52 Week High. $ Intraday Low. $ U.S. stocks tumbled as recession fears and other factors shook markets. The S&P suffered its largest weekly drop in 18 months. Two- and year U.S. Weekly Totals ; Unchanged, 92 ; New Highs, ; New Lows, ; Adv Vol, 8,,, Markets sold off this week following soft employment data and renewed growth concerns from investors. It's unlikely that these concerns will be put to rest. Most Popular. Read full story · Tesla's stock deserves a 'unique' valuation, according to the newest bull The stock market often falls in the 2 months leading. 52 Week Low US Stocks: Find the 52 week low stocks - including Dow Jones, NASDAQ, S&P Stocks performance, technical chart, historical data & more. World markets ; Dow. United States. 40, ; S&P United States. 5, ; NASDAQ. United States. 16, ; VIX. United States. ; Russell The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. New 4-Star Stocks. Alphabet and Hewlett Packard are among the With the firm's low prices and digital investments, here's what we think of Walmart stock. LOW | Complete Lowe's Cos. stock news by MarketWatch. View real stock rises Monday, still underperforms market. Sep. 9, at p.m. ET. Markets. Low stock market volatility masks 'pain under the surface'. Shareshare. Even as traders grapple with a slowing economy, banking turmoil and.